About Sentiment Inside Out

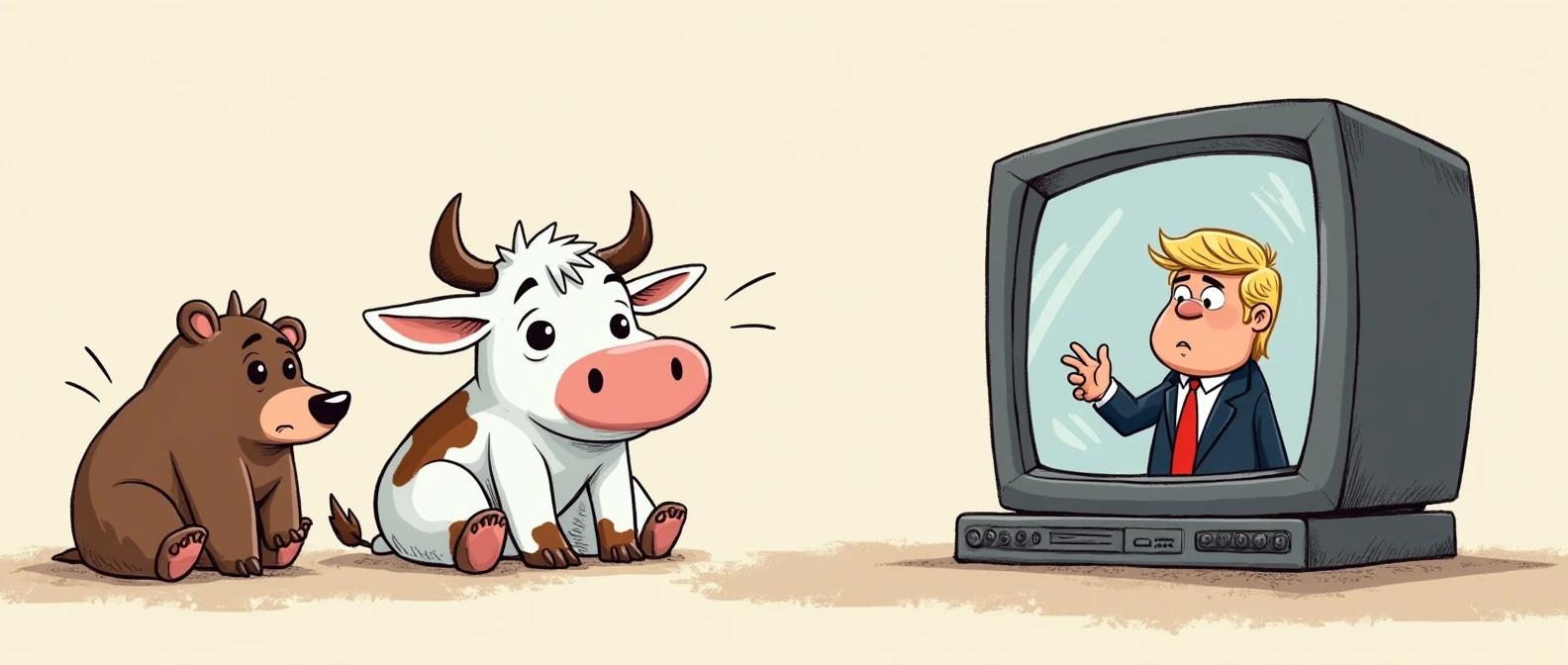

Market = Funds + Psychology

This is a famous quote from André Kostolany, author of 'The Speculator's Confession'. Funds = Fundamentals = Macroeconomics. Psychology = Investor Sentiment = Human Nature. I believe cycles stem from human irrationality, creating the peaks and troughs of the economy and stock market.

Fear and Greed

Economic data and company reports change monthly or quarterly, yet the capital market can fluctuate dramatically in short periods. This shows that sentiment's impact on price is no less than fundamentals. Some sell fearing it's too expensive; others buy fearing they'll miss out. As market participants, we should understand whether the market is currently in a state of fear or greed.

Overcoming Our Own Nature

I believe stock prices reflect market sentiment just as much as fundamentals. The website was founded with the goal of using simple charts and data to transform current market sentiment into important investment indicators, helping everyone overcome their irrationality and avoid chasing highs and selling lows based on emotion.